The Indonesian skincare market represents a vibrant and rapidly evolving sector within the broader beauty industry. Understanding its intricacies, including consumer demographics and prevailing trends, is essential for businesses seeking to capitalize on its growth potential.

The Indonesian skincare market has experienced significant growth in recent years, driven by increasing disposable income, changing consumer preferences, and the widespread adoption of social media. With a compound annual growth rate (CAGR) of 5.91% projected from 2022 to 2026, the market presents lucrative opportunities for both local and international brands.

One of the key drivers of market growth is the rising demand for skincare products among Indonesian consumers. Skincare has become more than just a routine; it has become a cherished ritual for many Indonesians. This shift in consumer behavior has propelled the skincare segment to account for approximately 30% of the beauty market in Indonesia.

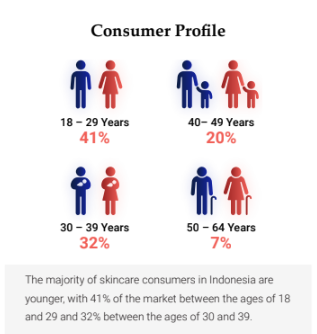

Understanding the demographics of Indonesian skincare consumers is crucial for businesses aiming to tailor their products and marketing strategies effectively. Most skincare consumers in Indonesia are younger, with 41% of the market aged between 18 and 29, and 32% aged between 30 and 39. This youthful demographic is increasingly drawn to skincare, influenced by beauty trends on social media and a growing emphasis on self-care.

Moreover, skincare usage is concentrated in urban areas, particularly big cities, where access to products and information is more readily available. Urban consumers are more inclined towards skincare, reflecting a shift towards modern beauty practices and wellness routines.

Regarding income demographics, 39% of skincare users in Indonesia come from households with high annual incomes. This segment of consumers can afford high-end, imported skincare products, contributing to the demand for premium offerings in the market. However, most skincare consumers in Indonesia set modest shopping budgets, preferring affordable local products that align with their price range.

Image Source: YCP White Paper

Indonesian skincare consumers are discerning and selective when it comes to choosing products. Safety, raw materials, and performance are top considerations, with 80% of respondents prioritizing certified products and paying close attention to ingredient lists. Halal certification holds particular significance in Indonesia, given its status as a Muslim-majority country.

Consumers also prioritize alcohol-free, dermatologically tested, organic, and non-comedogenic skincare products. These preferences reflect the meticulous approach Indonesian consumers take toward skincare, as they seek to achieve their desired beauty goals while maintaining the health and integrity of their skin.

Skincare products in Indonesia are distributed through an omnichannel approach, ensuring accessibility across various platforms. E-commerce plays a significant role in the Indonesian beauty market, with platforms like TikTok Shop driving sales through social media-integrated e-commerce experiences.

However, recent regulatory decisions, such as the ban on TikTok Shop, may impact the distribution landscape. Nonetheless, the market is expected to continue growing, with the proportion of internet sales projected to rise to as much as 27.2% by 2025. This growth will be driven by increased access to information about skincare products online and social media influencers' reviews.

Source: https://ycpsolidiance.com/white-paper/indonesia-skincare-industry-success

Digital Lending in Southeast Asia: Current Trends and Future Outlook

Digital lending in Southeast Asia (SEA) has been on an upward trajectory, significantly enhancing financial access for both individuals and businesses. The region's high internet and mobile penetration rates have facilitated this growth, enabling more people to access financial services conveniently. Governments across SEA are actively promoting digital lending as a means to improve financial inclusion, particularly for the underbanked and unbanked populations. For instance, digital lenders in countries like Indonesia and the Philippines have capitalized on the surge in internet usage to offer innovative lending solutions.

The Latest Trends and Developments in SEA’s Digital Payments Landscape

The adoption of digital payments in Southeast Asia (SEA) has accelerated, driven by technological advancements, government initiatives, and changing consumer behaviors. It has evolved from simple online transactions to sophisticated financial ecosystems that include various payment methods such as mobile wallets, QR code payments, and Buy Now Pay Later (BNPL) options.

Navigating the Digital Era: Future Jobs and Skills in the Age of Digitalization

The job market's transformation driven by digitalization highlights the need to understand emerging trends and acquire essential skills for thriving.

Navigating Key Challenges in Southeast Asia’s EV Market

Southeast Asia (SEA) finds itself at a crucial juncture in the journey towards electric vehicle (EV) production and adoption as the world transitions towards sustainable transportation solutions. The region has several significant keys for developing the EV industry, such as Indonesia's nickel supply and Thailand's EV manufacturing potential. However, the ASEAN EV industry faces many challenges and threats that must be overcome to ensure success in the region.