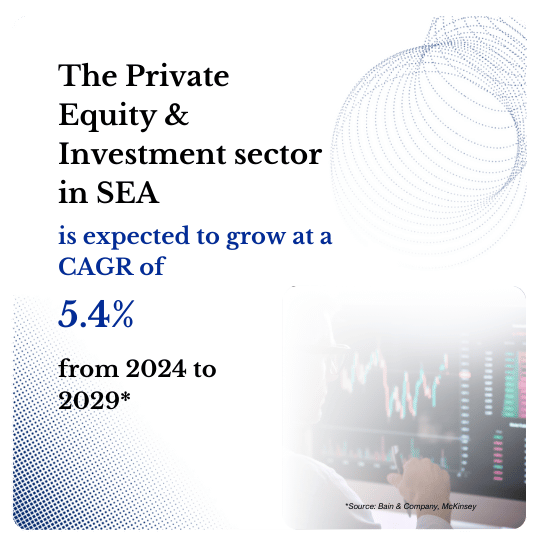

The Private Equity & Investment sector in Southeast Asia (SEA) is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2029. This growth highlights the region's expanding appeal to global investors seeking high returns in emerging markets. The sector's robust growth forecast is fueled by increasing interest in diversified portfolios, rising economic stability, and a surge in entrepreneurial ventures. This upward trend presents a significant opportunity for private equity firms and investors to capitalize on the burgeoning market and drive sustainable growth in the SEA region.

Several years ago, the SEA Private Equity & Investment industry was marked by moderate growth, with investments primarily concentrated in traditional sectors such as real estate, consumer goods, and manufacturing. The industry’s growth was relatively steady, driven by the region’s developing economies and the gradual entry of foreign investors. However, in recent years, the industry has seen a notable increase in activity, mainly due to improved regulatory environments, greater transparency, and a burgeoning startup ecosystem. These factors have significantly boosted investor confidence and attracted more capital into the region, leading to the current growth trajectory.

Today, the Private Equity & Investment sector in SEA is recognized as one of the fastest-growing and most promising sectors in the region. With a dynamic landscape that includes an increasing number of high-growth startups and innovative business models, the sector offers numerous opportunities for investors looking to diversify their portfolios and achieve substantial returns. The combination of a young, tech-savvy population and a growing middle class with rising disposable incomes is driving demand across various industries, making SEA an attractive destination for private equity and investment.

Market Research SEA is the leading advisory firm specializing in the Private Equity & Investment sector across Southeast Asia. With extensive experience and deep market knowledge, we provide valuable insights and strategic guidance to help businesses navigate the complexities of the SEA investment landscape. Our services encompass market entry strategies, competitive benchmarking, market assessments, operational support, mergers and acquisitions, and partner due diligence. We tailor our services to ensure our clients are equipped to leverage market opportunities and effectively address challenges in the evolving SEA Private Equity & Investment sector.

At Market Research SEA, our deep expertise, knowledge, and experience in understanding the unique characteristics of the SEA Private Equity & Investment market set us apart. We offer hands-on support to our clients, assisting them in developing and executing strategies that align with their goals and the specific dynamics of the region. Whether you aim to enter the market, expand your investment portfolio, or optimize existing strategies, Market Research SEA is your trusted partner in achieving sustainable growth and long-term success in the SEA Private Equity & Investment sector.

Determining the viability of M&A to improve your chances of financial success and growth

Learn about customer habits and spending to help you strategize your approach in the Southeast Asian market

Assisting you in improving your internal operations and maximize your performance in the value chain

We will come into the picture and help you identify industry trends, market environments, possible threats, and specific challenges that your business will face.

Our professionals are experienced in various strategic consulting areas and will deliver high-impact solutions for your business.

Contact Us